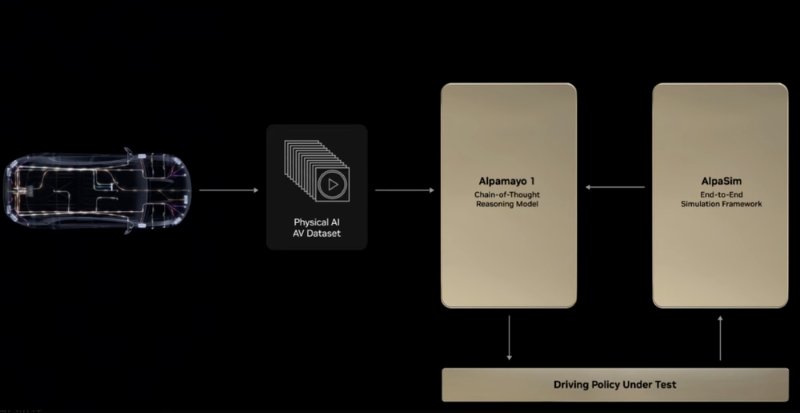

At the 2026 CES show, Nvidia defied expectations for new graphics cards and instead unveiled the groundbreaking open-source VLA (Vision-Language-Action) large model Alpamayo for autonomous driving. Simultaneously, it introduced the simulation framework AlpaSim and the Physical AI open dataset containing 1727 hours of driving data. With an end-to-end solution integrating “model + testing + data,” Nvidia officially launched a full-scale offensive in the autonomous driving sector, triggering significant industry shocks and a remote exchange with Tesla founder Elon Musk.

Open-Source VLA Model Solving Industry Pain Points

As the annual buzzword succeeding BEV and end-to-end technology, VLA’s core advantage lies in converting raw data collected by sensors into understandable language and symbols, then forming driving decisions through a traceable and interpretable reasoning process. This completely breaks free from the “black box operation” limitation of end-to-end solutions — it not only addresses the issue of untraceable intermediate processes but also frees algorithm optimization from the uncontrollable predicament of relying solely on data feeding, endowing autonomous driving systems with independent reasoning capabilities.

Prior to this, many enterprises had already bet on the VLA route. Xpeng, for instance, initiated relevant R&D as early as 2024 and quickly launched its self-developed second-generation VLA model shortly after Alpamayo’s release. Although Tesla has not disclosed its technical details, judging from the performance of FSD V14, its technical architecture is highly similar to VLA. The disruptive open-source nature of Nvidia’s Alpamayo has brought new possibilities to the industry, making it a highlight in the latest AI news.

For automakers, developing VLA models has long been plagued by three major challenges: acquiring high-quality data, training reasoning capabilities, and controlling computing power costs. Alpamayo is equivalent to a complete underlying template — automakers no longer need to build models from scratch. Instead, they can quickly form exclusive technical solutions by fine-tuning and optimizing based on their own data and brand needs, which not only lowers the development threshold but also retains algorithmic differentiation. Coupled with the supporting AlpaSim simulation testing framework and Physical AI dataset, Nvidia has achieved full-chain supply, promoting the realization of “autonomous driving equality.” In the face of this competition, Musk stated bluntly that “Nvidia only provides tools but has not deeply engaged in the automotive industry itself,” while emphasizing Tesla’s advantages in hardware investment and vehicle integration.

Software-Hardware Ecosystem Closed Loop: Nvidia’s Upgrade Path

In terms of industry status, Nvidia’s DRIVE series chips have long dominated the L2+ and above high-end autonomous driving market. Previously, delays in the mass production of Drive Thor disrupted the new car launch schedules of leading automakers, fully demonstrating its hardware dominance. However, data shows that from 2020 to 2024, the revenue of Nvidia’s automotive business accounted for less than 4% of its total revenue, far from matching the dominance of its data center business and failing to meet expectations.

The core dilemma lies in the contradiction in customer structure: while new power automakers such as Xpeng and NIO are its core customers, they are all advancing self-developed chips — NIO’s chips have already been installed in vehicles, and Xpeng’s Turing chips are imminent for mass production. On the other hand, traditional automakers with huge sales volumes, such as Volkswagen and Mercedes-Benz, generally lack autonomous driving algorithm R&D capabilities, making it difficult for them to fully utilize the advantages of Nvidia’s chips. Meanwhile, as a developer itself, Nvidia had little involvement in autonomous driving algorithm R&D in the past and could not directly meet the needs of traditional automakers.

To address this, Nvidia launched a strategic transformation, striving to build a closed-loop toolchain of “cloud-based training + on-vehicle reasoning.” On the hardware front, the latest DRIVE Orin/Thor platform not only provides chips but also comes with a complete hardware design blueprint for on-vehicle computers. On the software and service front, in addition to the open-source Alpamayo model unveiled at CES (Consumer Electronics Show), there is the physically accurate DRIVE Sim simulation platform, which can generate synthetic data and conduct extreme safety tests. Combined with the new-generation data center chip Vera Rubin and the world model Cosmos, a full-process solution has been formed.

The essence of this strategy is “promoting hardware through software”: by reducing the threshold for automakers to use its products with “nanny-style services,” it binds the sales of its own chips. This not only avoids falling into the low-margin predicament of customized projects but also taps into the huge market of traditional automakers. With the open-sourcing of Alpamayo, VLA technology is expected to accelerate its popularization, and the autonomous driving industry will move from the stage of “competition among a few players” to “large-scale implementation.” The route dispute between Nvidia and Tesla, as well as the ecological game between automakers and chip manufacturers, will continue to reshape the industry pattern and drive autonomous driving technology towards a new stage of development.