July 10, 2025 – U.S. chip-making giant Nvidia officially became the first publicly traded company in global history to surpass $4 trillion in market capitalization on Tuesday. Despite closing slightly below this milestone, the moment was reached enough to mark a major leap forward for the global tech industry and make Nvidia the world’s most market-capitalized company, surpassing Microsoft and Apple.

From gaming graphics to AI cornerstone, Nvidia’s road to the top

Nvidia’s leap was no accident, but the result of decades of deep work in the field of graphics processors (GPUs) and artificial intelligence hardware. In the past, Nvidia was known for its leadership in the gaming graphics card market, but since 2020, it has gradually shifted its business focus to cutting-edge areas such as artificial intelligence, big data, autonomous driving, and supercomputing.

Especially since 2023, when AI is exploding, AI acceleration chips such as H100 and GH200 launched by Nvidia have become the core hardware for major tech companies around the world to build large-scale language models and AI systems. From OpenAI’s ChatGPT to the AI clusters of Google, Meta, Amazon, ByteDance, Baidu, and other companies, none of them relies on Nvidia’s arithmetic foundation. The market called it “the fuel supplier of the AI revolution”.

According to the company’s latest financial results, for the second quarter of 2025, NVIDIA is expected to have revenue close to 45 billion U.S. dollars, full-year revenue exceeding 200 billion U.S. dollars, gross profit margin of more than 70%, much higher than the average level of the technology industry. Morgan Stanley and other investment banks pointed out that this high-speed growth rate in the current global economic slowdown, in the context of the background, is particularly prominent, and investors are still full of confidence in its future.

Detonation of the market value of multiple engines

NVIDIA’s rapid growth in market value in a short period of time stems from the superposition of multiple factors.

The first is the continued acceleration of global investment in artificial intelligence infrastructure. According to Bloomberg data, in 2025, the global AI computing power infrastructure investment is expected to exceed 750 billion U.S. dollars, with data center upgrades almost entirely around AI training and reasoning. NVIDIA, as a core chip supplier, occupies an irreplaceable position.

Secondly, NVIDIA has actively expanded its ecosystem in recent years, no longer limited to hardware manufacturing, but building a complete system covering GPU chips, software tools (such as CUDA), development platforms (such as Omniverse), and AI model optimization platforms (such as TensorRT). It is both a chip manufacturer and a platform provider, firmly controlling the upstream of the industry chain.

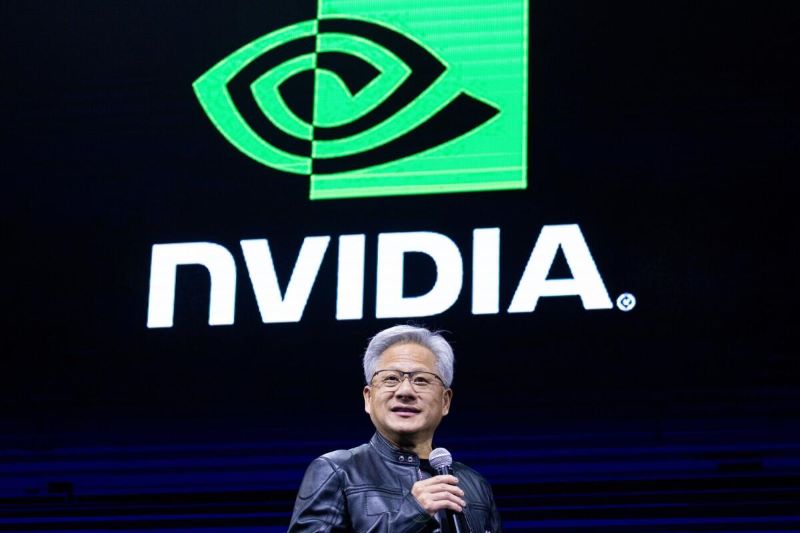

Furthermore, founder and CEO Jen-Hsun Huang’s forward-looking strategic planning is also highly praised. His judgment that “AI is about to become the new industrial revolution” is being verified by reality. Jen-Hsun Huang recently said on several public occasions, the future of AI robotics, generative AI, digital twins, edge computing, and other new scenarios will bring NVIDIA “trillions of dollars of market potential”.

Global capital market confidence wind vane

NVIDIA’s breakthrough of $4 trillion in market capitalization is not only the victory of a single company but also a reflection of market sentiment. The U.S. Nasdaq index has thus set a new record high, and technology stocks have risen as a whole, driving the confidence of the entire market back up. Microsoft’s market capitalization is currently $3.74 trillion, and Apple’s is $3.15 trillion, which is still at a high level but has been surpassed by NVIDIA.

Global investment institutions generally regard NVIDIA as the “Apple of the AI era”, is currently one of the few technology companies that can transform the technical barriers into certainty of commercial returns. UBS, Citi, Goldman Sachs, and other investment banks have raised their target price, as their market value in the next 12 months is expected to touch 5 trillion dollars.

However, some analysts have warned that they should be wary of the risk of overheated valuations. At present, NVIDIA’s price-earnings ratio has been much higher than the industry average, and the market’s expectations for its AI growth have been extremely optimistic. If future policy changes, chip export restrictions, technology updates stagnation, and other factors appear, it may affect the company’s valuation pullback.

Challenges and uncertainties

Although NVIDIA’s market value hit a record high, its road ahead is not a straight path.

On the one hand, the U.S. government’s export control policy on high-performance AI chips is becoming increasingly strict, especially for the Chinese market. NVIDIA previously customized a version specifically for the Chinese market downgraded version of the chip H20 is also facing export approval challenges; the international situation on its overseas business constitutes uncertainty.

On the other hand, competitors are rising in the market. Traditional rivals such as AMD and Intel are increasing their investment in AI chips, and startups such as Cerebras, Groq, and Tenstorrent are shaking up some segments of the market with customized chips. And cloud service giants such as Google, Amazon, and Microsoft are even developing their own AI chips in an attempt to get rid of their dependence on NVIDIA.

In addition, the rapid growth of AI arithmetic demand has also brought about the issue of energy consumption and sustainability. NVIDIA still needs to continue to make breakthroughs in how to provide green and efficient solutions in the future.

Toward an industrial engine for the AI era

From a three-person startup when it was founded in 1993 to the world’s No. 1 tech giant with more than $4 trillion today, NVIDIA has accomplished a stunning comeback in three decades. Its rise has not only witnessed the GPU moving from a graphics tool to the core of AI, but also symbolized the opening of a new era – AI is no longer just a scientific research concept, but a real driving force to reshape the industrial structure.

In this process, NVIDIA is both a promoter and a beneficiary. In the next decade, it will take time to see if it can stay ahead of the technological change and global game. But there is no doubt that today’s NVIDIA has stood at the top of the global technology and capital.

Leave a comment