USAR (USA Rare Earth, Inc.) is a leading enterprise in the U.S. heavy rare earth sector, focusing on building a vertically integrated full industrial chain covering rare earth mining, processing, and sintered neodymium-iron-boron permanent magnet manufacturing. Its goal is to provide an independently controllable rare earth magnet supply chain for the U.S. energy, technology, and national security sectors, as highlighted in the latest energy news. The company’s core asset is an 81% stake in the Round Top deposit in Texas, with estimated heavy rare earth resource value exceeding $80 billion. In March 2025, USAR completed a business combination to transform its operations and listed on the NASDAQ under the ticker symbol “USAR,” seeing its stock price surge by over 100% in the two weeks since early October.

USAR’s core competitiveness lies in multiple aspects. In terms of resources, the Round Top deposit is rich in high-value heavy rare earths such as dysprosium and terbium, along with associated strategic minerals like gallium and beryllium, providing a foundation of scarce resources. In industrial chain integration, it acquired LCM—a global manufacturer (outside China) with large-scale production capacity for rare earth metals and alloys—to fill gaps in the mid-stream segment. This makes USAR the only all-round producer in non-Chinese supply chains that covers light rare earths, heavy rare earths, and samarium-cobalt alloys for high-temperature magnets. Additionally, it plans a closed-loop system of “mining – material processing – magnet manufacturing – recycling” to achieve full supply chain autonomy. On the market front, USAR has signed 13 memorandums of cooperation with over 70 cross-industry clients, locking in approximately 2,000 tons of high-confidence annual demand, with long-term potential demand reaching 5,000-7,000 tons per year, spanning electric vehicles, industrial automation, and other fields. Moreover, its development aligns with the strategy of “de-risking” critical mineral supply chains of America government, positioning it to secure government funding support or long-term procurement agreements.

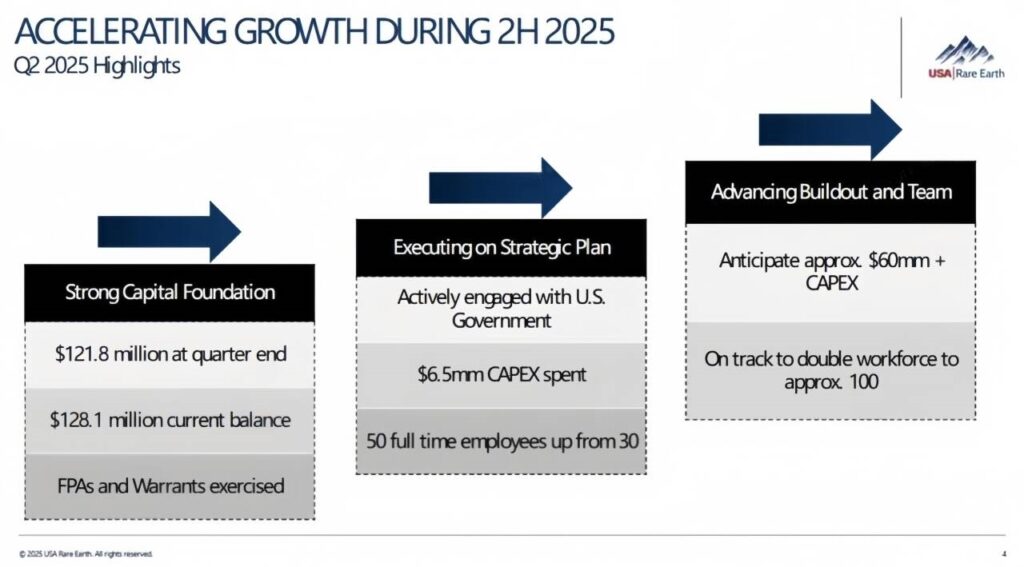

In terms of production capacity and finance, USAR adopts a phased capacity expansion strategy. The first phase of its Stillwater plant in Oklahoma, with an annual magnet capacity of 1,200 tons, is expected to operate at full capacity by the end of 2026. Upon reaching full capacity, it is projected to generate annual revenue of $150-200 million. The long-term capacity target is 5,000 tons per year, with room reserved for expansion to 10,000 tons per year. Financially, in Q2 2025, USAR reported a net loss of $142.5 million due to fair value adjustments of non-cash financial instruments; the adjusted net loss stood at $7.8 million. As of June 30, it held $121.8 million in cash and cash equivalents, sufficient to support the construction of the first-phase production line. Capital expenditure in the first half of the year was $6.3 million, with a full-year plan of over $60 million.

China’s new rare earth policies present both short-term challenges and long-term opportunities for USAR. In the short term, the new policies regulate the export of overseas products containing ≥0.1% Chinese rare earth components. If USAR’s raw materials include Chinese rare earths, its production continuity will be disrupted. Meanwhile, regulations on rare earth smelting and separation technologies may cut off its technical support from China, delaying capacity release. Furthermore, high overseas separation costs will force USAR to invest more capital in developing smelting technologies, increasing costs and potentially delaying its 2026 production launch plan. In the long run, the new policies highlight USAR’s strategic value, shifting its valuation logic from a commercial company to a strategic asset for national supply chain security. This positions USAR to gain more favorable policy support, financing conditions, and high-end market access, accelerating its rise as a core enterprise in the Western rare earth supply chain.

The global rare earth market is dominated by China. In 2024, China accounted for 48.4% of global rare earth reserves, 68.5% of global output, and 92.3% of global smelting and separation capacity, making it the only country with a complete rare earth industrial chain. In the U.S. market, USAR forms a differentiated and complementary relationship with MP Materials—MP Materials focuses on light rare earths and has secured government funding, while USAR specializes in the full industrial chain of heavy rare earths. Simultaneously, USAR and Australia’s Lynas jointly face the pattern of Chinese dominance. Although Lynas is a key supplier in the West, it struggles with high smelting costs and restricted capacity expansion. Against the backdrop of global supply chain restructuring, USAR is expected to leverage its advantages in resources, industrial chain, and policies to rise amid regulatory environments and become a key player in non-Chinese rare earth supply chains.