In November 2025, Silicon Valley-based humanoid robot startup K-Scale Labs announced its closure due to funding shortages and team disintegration, becoming the first Silicon Valley enterprise to fail in this sector. Once backed by investors like Y Combinator (YC) and renowned for its open-source approach, the company’s downfall is more than just an entrepreneurial setback—it marks a pivotal shift in the humanoid robot industry from “dream-driven storytelling” to “commercial reality”.

Strategic Misstep: From Open-Source Rising Star to Funding Collapse

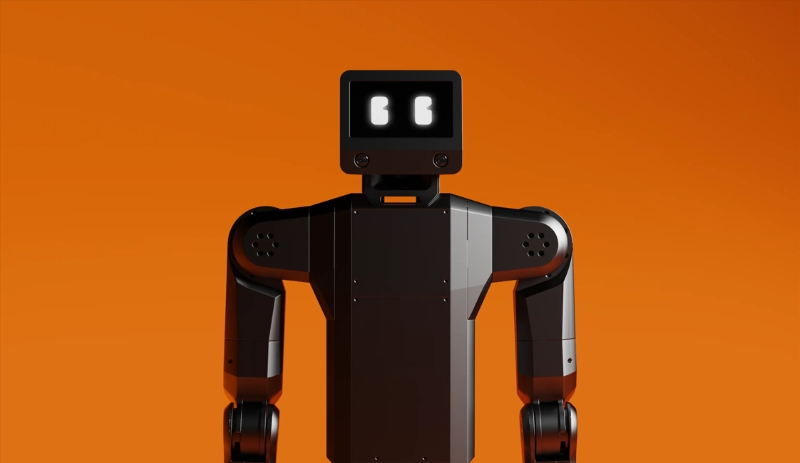

Founded in 2024 by former Tesla and Meta engineer Benjamin Bolte, K-Scale assembled a core team of seasoned robotics professionals. Leveraging open-source hardware designs and development tools, the company quickly gained traction in technical communities. Its early fundraising efforts were successful, securing a $500,000 seed investment from YC followed by an additional $6.25 million in subsequent funding. Initially, K-Scale adopted a prudent “small first, large later” strategy: launching the Z-Bot, a 46-centimeter-tall small robot priced under $1,000, to capture the untapped U.S. domestic market with its affordable price point, then using the cash flow to support the development of larger robots.

A turning point came with a venture capitalist’s funding promise: if K-Scale could launch the K-Bot, a 1.4-meter-tall large robot priced at $8,999, and secure 100 pre-orders, the VC would provide a $20 million Series A round. Tempted by the narrative of being a “serious company”—in line with industry players like Figure and Tesla that could tell billion-dollar stories—K-Scale made a drastic strategic pivot. It redirected core resources to the K-Bot, sidelining the Z-Bot, which was deemed too cheap and risked branding the company as a “toy maker.” However, large-scale robots pose significant production challenges and high costs. By the time the K-Bot was ready, market sentiment had shifted: investors moved from “evaluating demos” to “scrutinizing shipment volumes and cash flow,” and the funding promise fell through. Ultimately, the Z-Bot’s commercialization was derailed, the K-Bot faced mass production hurdles, and with only $400,000 left on its books, the company was forced to shut down.

Cash Flow and Real Customers: The New Lifeline

K-Scale’s collapse is not an isolated incident. Around the same period, companies like U.S.-based Dextrous Robotics and UK-based Small Robot Company also grappled with funding crises or ceased operations, unable to convert impressive demos into stable orders and cash flow. Behind this lies a profound shift in industry logic: on the capital front, investments between 2024 and 2025 have concentrated on top players like Figure and Unitree, while mid-tier and smaller companies face prolonged fundraising cycles, valuation adjustments, and cash flow strains. On the market front, “imaginary customers” cannot sustain a business loop, making real paying orders a scarce resource.

The global robot market faces similar challenges. Beyond a handful of enterprises solidifying their positions through shipments, most projects rely on non-market orders such as state-owned enterprise demonstrations, laboratory purchases, and peer-to-peer transactions. The industry has formed a new hierarchy: top firms have entered mass production, mid-tier companies depend on funding to sustain R&D, and smaller players struggle to “survive on limited resources.” K-Scale’s failure highlights three high-risk structures plaguing the industry: communication speed outpacing commercial validation, engineering progress outrunning market cycles, and overreliance on demonstrations and policies rather than market demand—issues that have become prevalent “growing pains” across the sector.

K-Scale’s demise serves as a wake-up call for the global humanoid robot industry. As the capital boom fades, this case, part of the latest robotics news, underscores that for entrepreneurs, finding truly paying customers and building a sustainable business loop is far more crucial than chasing grand narratives. This will be the core benchmark for future industry consolidation.