EST on Friday, September 20, U.S. stocks in the midday trading session, the Wall Street Journal, citing people familiar with the matter broke the news that recently Qualcomm has issued a takeover bid to Intel, and on the acquisition of the matter of contact with Intel. Subsequently, CNC also confirmed the news. This is also the second time this month, media reports that Qualcomm intends to acquire Intel.

Affected by the latest news, in the local time on Friday, U.S. stocks fell more than 3.7% in the afternoon session of Intel’s stock price rose sharply, the stock price high to $ 23.12 when the intraday increase of nearly 9.4%, compared with the intraday low of $ 20.35 highest rise of about 13.6%. A trading suspension was also triggered due to the excessive volatility of the stock. Although it retreated at the end of the day, Intel eventually closed at $21.84, up 3.31%, with market capitalization back up to $93.388 billion.

In contrast, Qualcomm’s shares were affected by the news in the plate appeared to fall rapidly, just about 10 minutes, the stock plunged to $ 164.30, the decline from the original less than 2% to expand to 5.5%, the tail end of the decline narrowed to 2.87%, closed at $ 168.92, market capitalization of 188.2 billion U.S. dollars.

The Wall Street Journal also noted in its report that people familiar with the matter warned that a deal for the acquisition was far from certain. Even if Intel were willing to accept it, a deal of this magnitude would almost certainly be subject to antitrust scrutiny. However, the deal could also be seen as an opportunity to boost U.S. competitive advantage in the chip space. In order to close the deal, Qualcomm may intend to sell some of Intel’s assets or parts of its business to other buyers.

For the rumors of Qualcomm’s acquisition of Intel, even if the news is true, Core Intelligence believes that the management of Intel is actively promoting the reform of the probability of not agreeing to the transaction, at least not without a sufficiently high premium will not agree to, I think it may be more than $200 billion to reach the heart of the matter, but the price of the Qualcomm may not be able to afford to give. Even if the deal is reached, in the United States to revitalize the local semiconductor industry in the context of the U.S. antitrust authorities may be inclined to approve the deal, but the EU and China’s regulators probability will not be approved. And once the deal fails, Qualcomm may also have to give a large break-up fee. So, this acquisition is really a bit unreliable!

Intel’s management’s “ambition.”

Although Intel in early August this year announced a bad second quarter financial results and financial measurement data, and announced a global layoffs of 15%, cut capital expenditure (cut $ 10 billion in capital expenditure by 2025), suspend quarterly dividends (the first time in 1992 to suspend the dividend), Intel’s stock price plummeted by more than 21% in a single day, Intel has been subjected to a lot of pressure from investors, the government, internal employees, public opinion and so on. Many aspects of the enormous pressure. It can be said that Intel is plunged into a major crisis since the company was founded 56 years ago.

This also triggered such as “Intel will sell wafer manufacturing business”, “Intel will sell FPGA (Altera) business”, “Intel will suspend the construction of overseas wafer fabs ”, “Qualcomm will acquire Intel” and a series of rumors.

However, after the subsequent Intel shareholders meeting, Intel CEO Pat Gelsinger (Pat Gelsinger) in the content of the open letter, although confirming the delay of Germany and Poland factory construction plan, but also denied the rumors of the sale of wafer fabrication business, the sale of the FPGA business completely, re-stated Intel’s accelerated transformation plan, but also announced the access to Amazon AWS partnership and the good news of a $3 billion subsidy from the U.S. Department of Defense.

Intel’s crisis and strategic transformation under pat Gelsinger

As the man at the helm of Intel, Kissinger said bluntly, “This is the most important transition Intel has made in more than four decades. We haven’t attempted anything this important since the memory transition to microprocessors. We succeeded then, and we will embrace this moment and build a stronger Intel for decades to come.”

As early as the beginning of 2021, Intel invited back the veteran Kissinger to take the helm again, Intel’s board of directors for Kissinger is also based on high expectations, hoping that such a technical veteran can lead Intel back to glory.

After Kissinger formally became CEO of Intel, it was a bold reform of Intel, and put forward the “IDM 2.0” strategy, focusing on the core of the advanced process manufacturing capabilities to enhance the product power, and at the same time, the design business and manufacturing business unbundled (open outsourcing OEM), and expanding production capacity, to open up the wafer foundry business. The company is also expanding its production capacity to develop the foundry business.

Obviously, this “IDM 2.0” strategy is not a short-term effect of the strategy, after all, when Intel and TSMC in the process process is in an embarrassing situation several years behind, while the global expansion of the fab itself is a very long cycle, and from an IDM manufacturer’s manufacturing business unit into a competitive TSMC Wafer foundry, more likely not overnight.

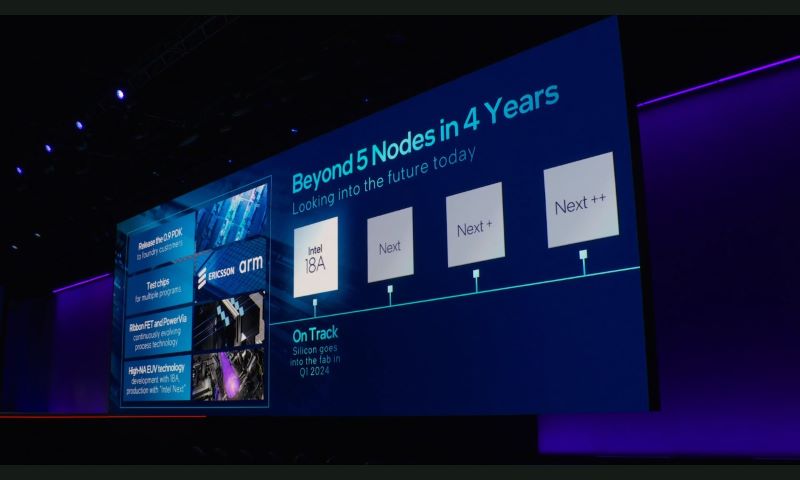

Up to now, Kissinger has been at the helm of Intel for more than three years, its proposed “five years, four advanced process nodes” plan will be completed on schedule, although in the process Intel missed the “AI data center” market has brought great opportunities in the Its share of the core data center market continues to be squeezed by NVIDIA, AMD, Arm and other competitors.

According to market research firm Mercury Research released data for the second quarter of 2024, compared with the same period last year, AMD’s market share in the three main CPU categories of servers, desktops and mobile have increased by a few percentage points, compared with Intel’s decline. However, even so, currently occupies 90% of the data center market share in the X86 CPU market, Intel still occupies about 70% of the market share.

In addition, Intel’s GPU business is growing steadily since its return to the GPU track in 2020. With its leadership in the data center CPU market, its data center GPU business has a bright future. And Intel also plans to move its next-generation AI gas pedal, to the GPU architecture, in order to better compete with NVIDIA.

For Kissinger, the next Intel will be mass-produced in the first half of 2025 Intel 18A process will be the key to its turnaround. Not only Intel’s next generation of PC and data center field of main products will return to internal manufacturing, and use the latest Intel 18A process, Intel is also counting on Intel 18A to win more foundry customers. Intel is committed to leveraging new technology to enhance its competitiveness.

Recently, in order to ensure the smooth mass production of Intel 8A process in 2025, Intel also announced to “skip the productization” of Intel 20A node, ahead of the engineering resources from Intel 20A to Intel 18A, which will use the Intel 20A has been completed on the process of RibbonFET full wrap-around gate transistor architecture and PowerVia backside power technology. According to data released by Intel, the defect density of Intel 18A has now reached the D0 level, which is less than 0.40 (def/cm^2). This indicator means that Intel 18A process nodes are generally considered production-worthy and in good operating condition.

The current Intel announcement shows that Microsoft plans to use the Intel 18A process node to produce a chip of its design. Intel will also utilize the Intel 18A process to produce AI Fabric chips for AWS.

It is foreseeable that if the Intel 18A process is successful, it will not only help Intel’s own products to expand its competitiveness, but will also succeed in opening up the situation for Intel’s foundry business. According to Intel’s projections, some foundry revenue from external customers will be generated in 2026, and “meaningful” revenue in 2027.

In addition, the suspension of the combined cost of up to nearly 35 billion euros of German wafer fabs and Polish packaging plant construction program for two years, will greatly ease the next two years of Intel’s capital expenditure pressure. At the same time, Intel’s U.S. domestic factory building program continues to advance, will be expected to obtain the $8.5 billion in direct subsidies previously reached with the U.S. Department of Commerce and $11 billion in loans. Coupled with the latest announcement of the U.S. Department of Defense will receive $ 3 billion in funding, these funds will help Intel significantly alleviate the current and subsequent capital needs of the factory project under construction.

It can be said that the crisis faced by Intel in the transition process must face the “pain”, but the crisis has not yet reached the point of “survival”, the outside world of all kinds of public opinion and speculation may be too much amplification of the “sense of crisis”. Sense of crisis”.

Future prospects: the role of the Intel 18A process in recovery

At present, Intel can still play a lot of cards, whether it is to continue to promote Altera’s IPO, or completely sell Altera, can be a large sum of money back for it to solve the current crisis. After all, when Intel acquired Altera in 2015, it spent $16.7 billion. And in 2022 AMD completed the acquisition of Xilinx is spent more than $ 35 billion (the back with AMD stock price rose to make the final transaction value significantly more than the initial price of $ 35 billion).

In addition, Intel can also follow the example of AMD when divested wafer manufacturing business (became the later Gexin), the wafer manufacturing business completely sold to solve the current crisis, but due to the advanced process manufacturing capacity is the key to the IDM 2.0 strategy, this possibility is not large. But when the wafer manufacturing business independent operation into the track, Intel probability will also promote the business of independent IPO, in order to recycle capital, reduce risk.

From the present point of view, if the board of directors continue to trust Kissinger, then Kissinger at the helm of Intel during the period, will continue to promote the completion of Intel’s strategic transformation, in order to realize its “in the next few decades to build a stronger Intel” commitment. Of course, if the completion of the transformation is still not effective, then Kissinger may then face “dismissal”. But before that, as a technical veteran who has worked at Intel for more than 30 years, Kissinger would never agree to sell the company to a competitor during Intel’s major transformation process, which has seen the company’s stock price at an all-time low since 2015.