According to the latest blog post in DigiTimes’ “Tomorrow’s Headlines” section, based on interviews with several industry insiders, Apple will be the first customer to adopt TSMC’s 2nm process. It is reported that Apple, as one of TSMC’s largest customers, has almost all of TSMC’s 3nm process capacity. Apple’s 2023 releases of iPhones and Macs feature 3 nm chips. Specifically, the A17 Pro chips in the iPhone 15 Pro models and the M3 series chips in the Mac are manufactured based on the 3 nm node.

According to reports, TSMC is expected to begin mass production of 2nm chips in the second half of 2025, which means that the iPhone 17 Pro will be the first mobile phone model to use the 2nm process. Currently, TSMC for 2nm process mass production construction of the Hsinchu Science Park Baoshan P1 fab, the fastest will start installing the relevant equipment in April this year.

It is understood that the TSMC 2nm process will replace the transistor architecture, from FinFET to GAA, compared to the N3E process, N2 in the same power consumption under the speed increase of 10% -15%, or the same speed power consumption reduction of 25% -30%. TSMC has also developed 2nm with a backside power supply solution, which is used to help customers achieve a balance between performance, cost, and maturity.

High Chip Cost

From the perspective of the entire process of AI chip production, the cost of a chip mainly includes the cost of raw materials, manpower research, and development, mask, packaging, and testing; at the same time, the chip’s manufacturing design to the wafer fab investment, wafer fabrication, IC design, algorithm design, code development, testing and verification, data processing, and chip packaging. Among them, the chip design R & D investment requires huge capital investment, according to the Microelectronics Research Centre IMEC disclosed data, the design of a 28nm process chip needs about $ 50 million, a 14nm process needs $ 100 million, a 10nm process needs $ 180 million, 7nm process needs nearly $ 300 million, the 5nm process about $ 550 million, 3nm for $ 600 million, the 2nm is nearly $800 million.

Semiconductor Chip Manufacturing Process

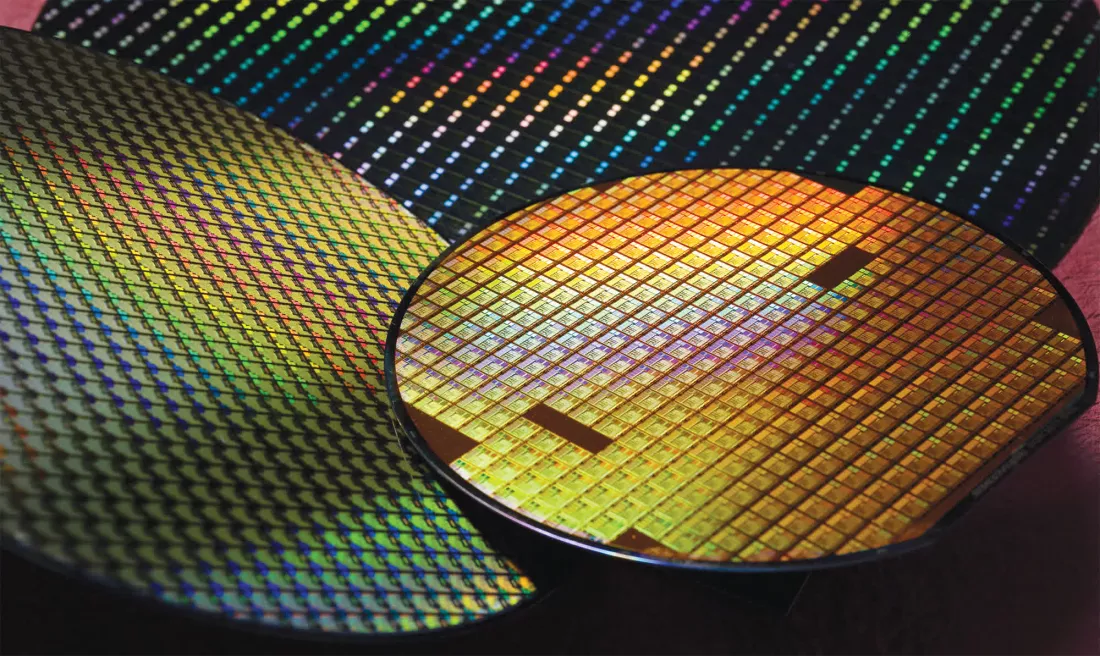

Chip (integrated circuit) manufacturing is the carving of complex circuits and electronic components on a silicon wafer (using thin film deposition, photolithography, etching, and other processes) while transforming the required parts into active devices (using ion implantation, etc.). The chip manufacturing process can be divided into a front-channel process and a back-channel process. The front channel refers to the process of a wafer fabrication plant, in the blank wafer to complete the circuit processing, the factory product is still a complete round wafer. The back-channel refers to the process of packaging and testing, in the sealing and testing plant will be cut into round wafers into individual chip particles, complete the shell of the package, and finally the terminal test, the factory for the finished chip.

AI chip R&D Costs Increase

With the continuous development of artificial intelligence, the demand for artificial intelligence technology in various industries has gradually increased. In recent years, with the intensification of international competition, as well as global epidemics affecting various industries, the price of chips has also risen. From the industrial chain, the chip price increase is mainly due to the increasing R&D costs, the limitation of 7nm chip process technology, the difficulty of implementing excellent chip design solutions, and the shortage of high-end chip supply, which has led to the increase in the global chip price level. As an important raw material for AI chips, the tight supply of monocrystalline silicon has led to price increases in the chip market.

Although Apple was revealed to be equipped with a TSMC 2nm chip process, many analysts have made new predictions on the prospects of Apple. Piper Sandler analyst Harsh Kumar recently downgraded Apple’s rating from “hold” to “neutral”, with a target price of 20 percent. Piper Sandler analyst Harsh Kumar recently downgraded Apple’s rating from “Hold” to “Neutral,” with a price target of $205, citing concerns about iPhone inventory levels and sales growth rates peaking. It is worth noting that Kumar has held a bullish view on Apple since March 2020 until the current revision. In his report, he wrote: “We are concerned about handset inventories going into the first half of 2024, and also believe volume growth rates have peaked.”

Leave a comment