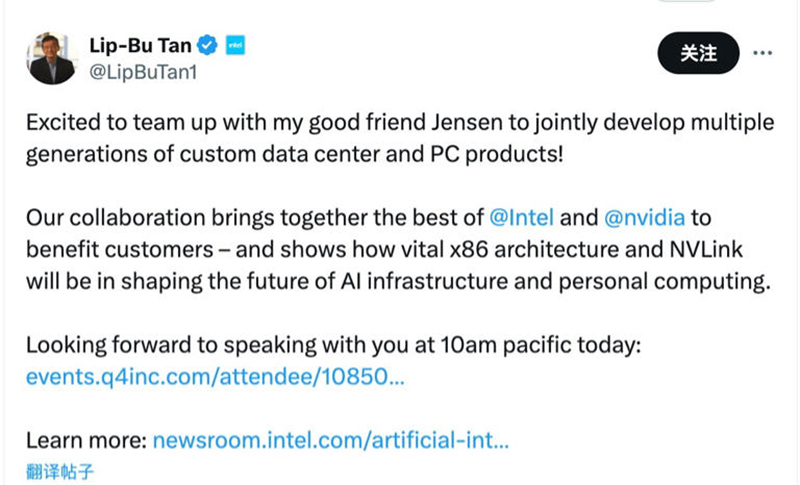

On September 18, NVIDIA announced the acquisition of Intel shares worth $5 billion at a price of $23.28 per share. Behind this acquisition lies a microcosm of the seismic shifts in the global chip landscape in recent years. In the ever-changing technology industry, the chip sector has always been one of the most fiercely contested battlegrounds. Over the past two decades, Intel undoubtedly reigned as the absolute dominant force in the chip industry. With its deep expertise in x86 architecture processors, it held sway over the PC and server markets, from desktop computers to data centers. Its chips were virtually ubiquitous, and its technological prowess and market share left competitors far behind. At that time, NVIDIA was still a small company focused on the graphics processing field. Even as it began to make a name for itself in the gaming graphics card market, its industry influence paled in comparison to Intel’s.

Who could have predicted that NVIDIA would now ride the tailwind of AI to rise powerfully, acquiring $5 billion worth of Intel shares and forging a deep collaboration? The news ignited the capital markets, with Intel’s pre-market stock price surging over 20%. This marks not only a turning point for the two companies but also reflects the profound transformation of the global chip landscape.

The wave of AI has completely rewritten the competitive rules of the chip industry. NVIDIA keenly captured the demand for high-performance computing driven by AI. The unique advantages of its GPUs in parallel computing have made them the “core tool” for AI training and inference. With the rapid development of deep learning, NVIDIA’s GPUs have been in short supply, its performance soaring, quickly propelling it into the top tier and even granting it dominance in the AI chip sector. In contrast, although Intel has a solid foundation in the traditional chip market, its transformation in the AI track has been slow. Its former “moats” are constantly being eroded—among which, the rise of Chinese chip companies is a key variable.

In recent years, Chinese companies have made continuous breakthroughs in the chip field, gradually breaking technological barriers from design to manufacturing. Whether in the large-scale production of mature process chips or innovations in niche sectors such as AI chips and automotive-grade chips, Chinese companies have achieved a leap from “following” to “running alongside.” For example, AI inference chips launched by some Chinese chip design companies already boast energy efficiency ratios competitive with those of international giants. On the manufacturing side, companies are continuously narrowing the gap with advanced processes through technological iteration.

These breakthroughs have not only disrupted Intel’s monopolistic inertia in the traditional chip market but also opened up new dimensions of competition in the global chip supply chain. The “one dominant player” structure that Intel once built relying on technological barriers and supply chain advantages is gradually loosening under the impact of multiple forces. The growth of Chinese companies has made the trend of the global chip market shifting from “unipolar dominance” to “multipolar competition” increasingly evident. The collaboration between NVIDIA and Intel is, in essence, a strategic choice by industry giants to respond to changes in the landscape. For NVIDIA, Intel’s advantages in x86 CPU technology and large-scale manufacturing can provide hardware support for its AI infrastructure platform. For Intel, leveraging NVIDIA’s AI expertise can help accelerate its efforts to make up for its shortcomings in emerging sectors. The competitive pressure brought by Chinese companies adds a sense of urgency to this “mutual pursuit.”

Based on the latest news, the customized x86 CPUs and SOC chips integrated with RTX GPUs launched through their collaboration represent not only a complementary advantage at the technological level but also a proactive change to address global competition. From an industry perspective, this collaboration, intertwined with the rise of Chinese companies, is reshaping the global chip ecosystem. On one hand, competition is no longer confined to a single company or country but has evolved into a comprehensive contest involving technological innovation, supply chain resilience, and ecosystem building. On the other hand, the trend toward diversification of technology roadmaps is becoming increasingly clear—AI chips, customized chips, and mature process chips each have their own lanes, no longer following the Intel era’s “one company sets the standards” model.

The era of Intel’s unilateral dominance is unlikely to return, not only because of the rise of emerging giants like NVIDIA but also because the participation of emerging market forces like China has brought more diverse innovation directions and competitive possibilities to the global chip industry. Of course, the process of restructuring the landscape remains fraught with challenges. Chinese companies need to continuously break through in core technologies and respond to uncertainties in the external environment. The collaboration between NVIDIA and Intel must also bridge gaps in corporate culture and interest distribution. However, one thing is certain: the era of “one dominant player” in the global chip industry is fading away. A new landscape of multipolar competition and diversified innovation will inject more lasting vitality into the entire technology industry—and this transformation has only just begun.