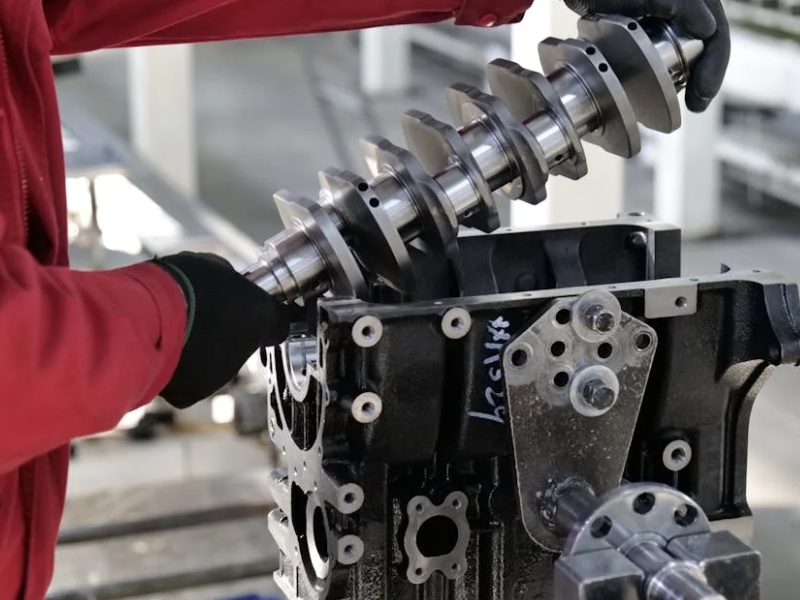

The European machinery and equipment sector, led by Germany’s manufacturing industry, is facing significant challenges from a new round of U.S. tariff measures. According to the German Mechanical Engineering Industry Association (VDMA), if the United States proceeds in December with plans to expand tariffs on machinery and equipment containing steel and aluminum, the share of German and European machinery exports to the U.S. affected by these duties could rise from the current 40% to around 56%.

This warning stems from a procedure initiated by the U.S. Department of Commerce to add more machinery products containing “metal components (especially steel/aluminum)” to its tariff list. The VDMA warns that if included, these products could face import tariffs as high as 50%. Companies failing to accurately prove metal content or origin may even face punitive tariffs of up to 200%.

For Germany’s export-dependent machinery sector, such uncertainty poses not only cost challenges but strategic risks. The VDMA stated: “The agreement is both unpredictable and unstable for our industry.”

Manufacturing Faces Transatlantic Strain

For German and European machinery manufacturers, the implementation of new tariff measures would directly expose European equipment producers to a sharp rise in export costs. The erosion of their price competitiveness may force some companies to withdraw from the U.S. market. The more profound impact lies in the restructuring of supply chains—many American manufacturers have long relied on high-end European equipment in sectors like semiconductors, aerospace, and defense. The cost increases and compliance complexities triggered by tariffs are now undermining the foundation of this transatlantic cooperation.

For small and medium-sized enterprises (SMEs) in particular, meeting administrative requirements like material traceability and metal content certification has become an almost impossible task. As industry representatives warn, these bureaucratic hurdles will marginalize the most innovative SMEs. From a broader perspective, this tariff dispute threatens the stability of transatlantic industrial chains: EU retaliatory measures would further erode mutual trust between Europe and the U.S., while European manufacturers heavily reliant on American suppliers would be forced to accelerate “supply chain diversification” strategies. This could trigger a profound restructuring of the global high-end manufacturing landscape.

VDMA Urges EU to Review Deal

Faced with this situation, the VDMA has explicitly called on the EU to “renegotiate the current so-called tariff/customs agreement” to ensure the machinery sector gains a clear and stable tariff framework, rather than “a gray area where additional taxes could be imposed at any time.” Specifically, VDMA urges the EU to negotiate: explicitly exempting machinery and equipment from high steel and aluminum tariffs, reducing administrative compliance burdens, and providing policy support—particularly for small and medium-sized machinery manufacturers.

Future developments hinge on three critical junctures: whether the U.S. government expands its tariff list in December, the strength of responses from the EU and Germany, and the establishment of compensation mechanisms. Should the U.S. implement the expansion, over half of Germany’s machinery exports to the U.S. would be impacted, triggering profound supply chain adjustments. Successful negotiations, however, would restore the stability the industry requires.

This tariff dispute has transcended ordinary trade friction, becoming a litmus test for European-American industrial cooperation and supply chain resilience. Its outcome will profoundly shape the future trajectory of transatlantic trade relations.